Konrad Mizzi avoids questions about Gasol plc’s technical insolvency

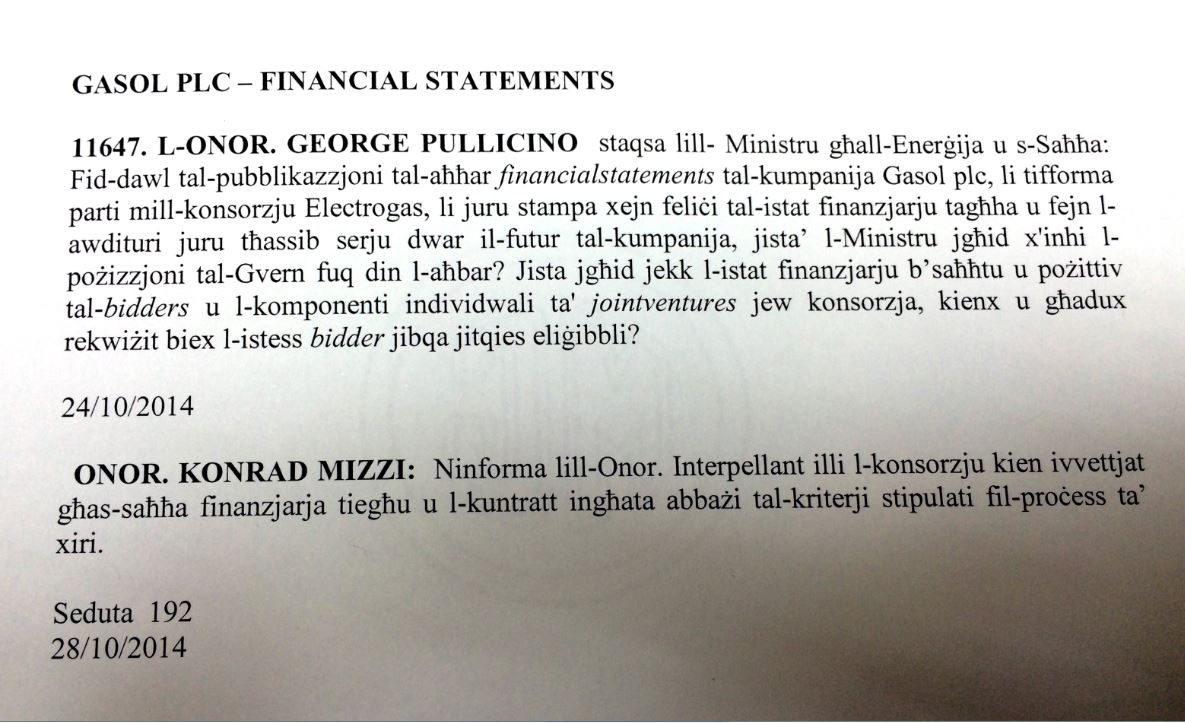

George Pullicino has asked the Minister of Energy and Health in parliament:

In the light of the publication of recent financial statements by Gasol plc, which forms part of the Electrogas consortium, which financial statements show a less than happy situation in which the auditors express their grave concern about the company’s future, can the Minister say what the government’s position is on the matter?

Will he say whether sound finances are still a requirement for the bidders and individual components of joint ventures or consortiums for the power station project, if this same bidder is still to be considered eligible?

Konrad Mizzi’s reply is:

My honourable interlocutor is informed that the consortium was vetted for financial soundness and that the contract was awarded on the basis of the criteria stipulated in the purchase process.

9 Comments Comment

Leave a Comment

And that is answering the question?

Parliamentary questions are an integral part of the checks and balances in a parliamentary democracy. But to Labour they are just a bother to be dealt with in as perfunctory manner as possible.

Doesn’t the office of the Auditor General have the authority to investigate issues like this?

Shouldn’t the Opposition take the matter to the Auditor General, together with the other issues which have emerged, including the involvement of Shell?

About Gasol:

What were the award criteria?

Who set the award criteria?

Were the award criteria stringent and in line with best practice?

Who checked that the award criteria were complied with?

What are the competences of those who checked compliance with the award criteria?

How and on what basis were those who checked the compliance selected and appointed?

Can the Minister table a report by those who checked compliance showing how they evaluated the bidders against the criteria?

Did the award criteria permit the elimination of technically bankrupt companies from the bid? If not, why not?

What is the Auditor General’s assessment of the financial position of Gasol plc?

Does the Auditor General believe that the technical bankruptcy of Gasol plc is “a smoke without a fire”?

Meanwhile, Ethelbert Cooper – the “serial Liberian entrepreneur” who founded and majority-owns Gasol plc – is more worried about a “naming opportunity” than with financing the Electrogas Consortium to save Joseph Muscat’s face with the Maltese electorate.

On second thoughts, why doesn’t Muscat offer Cooper the opportunity to name the power station after him: “The Ethelbert Cooper Empire Station” – as long as he delivers it on time in March 2015? As Professor Gates – also known as Skip – says, miracles happen.

If it took Cooper 5 years to realise his naming opportunity in an Arts gallery, how long is it going to take him to give Joseph Muscat his shaming opportunity with the power station?

“During the talk, Gates recalled how a deal was struck with Ethelbert Cooper to create the gallery.”

“[Cooper and I] were sitting there, it was sleeting and he said…I want a naming opportunity. I want my name on something at Harvard,” Gates said to laughter. Gates then told Cooper that no university had created a gallery explicitly for African and African-American art and that this endeavor would be “the greatest thing.”

The Ethelbert Cooper Gallery of African & African American Art opened Tuesday night at the Hutchins Center for African & African American Research after a discussion with curators David Adjaya and Mariane Ibrahim-Lenhart, moderated by Henry Louis Gates.

“And now lo these four or five years later we’re opening the Cooper Gallery,” Gates said. “I mean who says that there aren’t miracles, right?””

http://www.thecrimson.com/article/2014/10/22/cooper-gallery-african-art/

Did they have a signed letter from Gasol’s bank, stating that Gasol was financially sound?

Good point, Gahan.

Shouldn’t Konrot Mizzi be challenged to publish it?

Well one does not need to be a financial genius to realise that not all is on track with the consortium.

The fact that the €30 million was meant to be paid on signing of the contract, then we were told that the funds would be paid in instalments. Then we were told that the contract was actually signed what last week and again no €30 million, again to be paid in installments.

If the consortium cannot raise the €30 million, how is it going to raise what €180 million to build the new power station?

Even a clerk with any local bank vetting a loan application would stamp REFUSED on the application!

This government must really believe that us Maltese and Gozitans alike are ALL imbeciles.

“Even a clerk with any local bank vetting a loan application would stamp REFUSED on the application! ”

Not so fast. Don’t forget that the government has the privilege to appoint a chairman at BOV.

Now have a look at this:

http://uk.linkedin.com/in/damientay

1. Says that:

“Gasol plc’s strategic investor base comprises

(i) Afren plc—LSE-listed; US$ 2.0bn+ market cap oil and gas exploration & production company;

(ii) Afren’s principle co-founder, Mr Ethelbert Cooper; and

(iii) SOCAR Trading—the marketing & development arm of Azerbaijan’s national oil company ”

Confirms the investor/owner link to Ethelbert Cooper – a “financial engineer” who is mentioned as one of those who financed the warring factions in Liberia’s civil wars.

Confirms also the link to Afren plc, a company whose CEO, Osman Shahenshah, was director of Gasol up to 2012 and was co-founder of Afren with Cooper. Afren holds a stake of 14% in the share capital of Gasol plc.

Confirms the financing (loans, mainly) from SOCAR Trading – company ultimately controlled by Ilham Aliyev, the President of Azerbaijan who, according to Anglu Farrugia, was re-elected in free and fair elections.

2. It says also that Damien Kain-Ping Tay was involved in key transactions including:

“Malta LNG-to-Power Project

• Sponsors: Gasol (30% stake), Siemens Project Ventures, SOCAR Trading and Maltese investors

• Installation of a Floating Storage Unit (FSU) and regasification equipment to receive and regasify periodic LNG deliveries into natural gas. Gas will be supplied to 2 power plants, one of which will be a newbuild 205 MW CCGT developed by the consortium

• Project cost c. € 370m; project financiers: HSBC, BNP Paribas, KfW-IPEX and Bank of Valletta”

HSBC and Bank of Valletta, ha?

Has a letter of intent been issued by the relevant banks, have the relevant conditions imposed in the letter of intent been met?

Have the banks passed on any funds to the consortium after the the relevant contract between the consortium and the banks involved been passed?

Also is it not so that Socar will not be supplying the gas, but now Shell is the provider?

Every statement that this Minister, supposedly an expert in the matter, raises more questions than answers.

I mentioned Osman Shahenshah above but I failed to remind the readers that Mr. Shahenshah was dismissed from the board of Afren plc earlier this month after an investigation by an independent law firm which found evidence that he and other directors in Afren had received unauthorised payments from unauthorised deals with partners of Afren in oil fields in Nigeria. The investigation found other evidence of breach of good governance by Mr. Shahenshah. Afren said it will be suing Mr. Shahenshah and others for the money which amounts to several tens of millions of dollars.