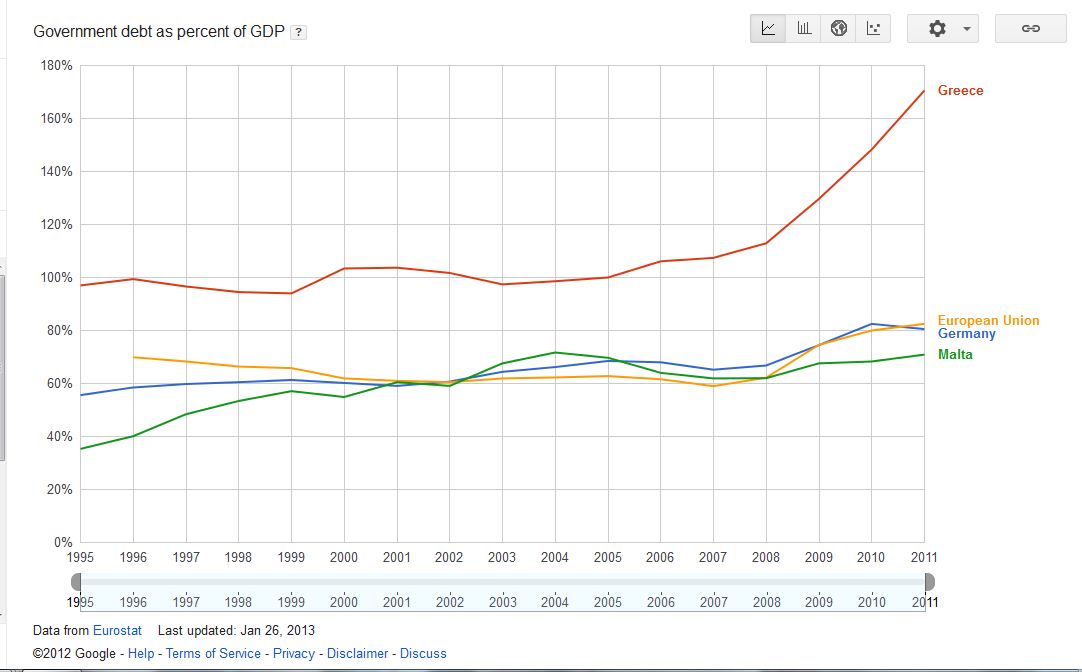

Government debt as a percentage of GDP: as a graph, for those low-IQ switchers who don’t understand words

Published:

February 2, 2013 at 1:24am

When I hear a bunch of idiots who left school with one O-level (if that, and it wasn’t maths) bang on about government debt, the deficit, GDP and ‘id-dejn’, getting them all confused and not being able to tell the one from the other or their Herbalife food substitute drink, I want to set them up on a really hot date with Edwarrrrrd Scicluna, so that he can confuse them even more.

The truth, the facts, are here:

17 Comments Comment

Leave a Comment

I think debt per capita is a much better indicator.

Would that include credit card and household debt? The British are probably the record-holders here. Incidentally, this is an indication of good economic performance, or at least economic confidence, which is what it’s all about.

HP, I am afraid that you are wrong with respect to consumer credit being an indication of good economic performance.

Spend amounts and locus of that spend are the indicator.

If debt is largely frivolous, e.g., borrowing 30k to buy a new car or government upgrading ministerial fleet, then that is negative.

If that debt is investment spending, then the entire story changes to the positive (for example, investing in infrastructure that enables industry to be more competitive plus positive responses from industry which sees increases in gainful employment).

This is the point that few understand. The PN do borrow and we have over extended ourselves. However, one needs to look at why the borrowing.

From the state of the economy, my guess is that a good part of it went to infrastructural spend.

The figure above, therefore, doesn’t say much except our debt is lower than average.

It needs to be supplemented by the rate of government investment expenditure in contrast to the EU average.

HP, personal debts including credit cards and personal borrowings are not ‘national debts’.

The ratio of national debt to GNP are accumulated government deficits to the Gross National Product The National debt is the government’s responsibility to service/reduce/control but personal debts are the consumers’ responsibility.

Laburisti can criticize all they want and it is true that the national debt was low in their time, but that was because the GNP was so low that it could not possibly sustain a manageable national debt. That’s why the infrastructure was left to rot and no water was available at the taps.

Malta debt per capita end 2011 13,500

Greece 35,000

Uk 25,000

Now when Labour win the election, and through their ill-thought-out policies the economy comes to a grinding halt, with government debt ballooning out of control, the trend line for the Maltese economy will rise close to vertically.

Good going, Joey.

I wonder how many years it will take the country to recover from the ruinous forthcoming Labour government.

Lucan, when you consider the ratio of debt to GDP you’re taking account of the ability of the economy to cater for that debt.

If I owe 1000 euros and I earn 200 euros per month, I have a problem but if I owe the same amount or more and I earn 2000 euros a month it’s a different story.

According to that economic genius Edward Scicluna, Malta is worse off than Greece.

By the way, most of the debt we talking about is held by local private individuals and companies, which means that the millions paid by the government as interest to service the debt are channeled back into the economy for consumption or re-investment. But I do not expect PL supporters to know these things. They are much more into hunting and gel nails.

Dear Daphne,

Unfortunately you manage to fool only those with a primary level of education.

You very conveniently avoided 2012 where debt to GDP jumped to 75%

You alse very conveniently did not plot Spain, which had a lower debt level than Malta….and you know that their “Finanzi” are not “fis-Sod”

You also failed to label Standard and Poor as idiots with low IQ, because they claim that Malta’s debt lies at 95% because there are 20% more debt hidden in SPVs.

I strongly suggest you buy “Macro-Economics for Dummies” from Amazon

[Daphne – I did not plot or avoid anything, V Cardona. This is an intact screen-shot of a Eurostat official graph. You can see the date and reference right there. No, I don’t fool those with a primary level of education. Those are not my audience because they cannot read, still less read idiomatic English or understand the concepts. The fooling of people with primary-level education is Labour’s specialisation. If you look at surveys of voter habits, you will see that almost all of those who left school in childhood vote Labour.]

Valid point. Spain (and Cyprus) do have the same level of debt as Malta. And, honestly, is Malta really comparable with Germany?

German banks were the worst hit by the financial crisis, Germany is a net contributor to the EU budget and in Germany they actually have proper roads. Malta, on the other hand…

Hallina, Cardona. SPV Malita was oversubscribed by the Maltese in a few days. No government financing there.

This government is clean and Eurostat know it. You don’t, it seems.

V Cardona, it appears that you have read “Macro-Economics for Dummies”, and dammit, you have not even learned anything from it! Just like Joseph and Edward, with all their degrees in economics keep miscalculating and misleading.

Any time during a year, the debt to GNP can exceed 75%, but usually it is a snapshot taken when government revenues are not yet calculated. End of year figures, after all revenues for the period are in, is the only accurate indicator.

Spain may have had a lower debt than Malta only because the government had no vision to (or could not) inject money into an ailing economy to stimulate growth, or at least maintain job levels. In contrast Malta spent millions shoring up industry which not only survived and preserved jobs, but actually expanded after government intervention. Did the injection raise the deficit? Yes, but how much more would it have cost Malta if it lost plants and hundreds lined up at the unemployment line?

You and Standard and Poor’s can safely claim that Malta’s debts are at least 300% of GNP, if you include all debts including borrowings by public and private enterprises and personal debts. So what is so new in your thinking? You have to compare like with like, so please support your claims by also quoting other countries’ comparative figures. I suppose a simpler version of “Macro-Economics for Dummies” is overdue, and which may help you comprehend Macro-Economics better.

Do separate facts from fantasies.

Perhaps V Cardona would like to tell us how Labour’s 360 million capital expenditure, their figure, on a new plant whilst restricting the interconnector, effectively rendering it wasted capital, that’s another 200 million, is going to help Enemalta.

Unless V Cardona is one of those who think the interconnector will only be ready by 2018.

It seems to be contagious.

http://www.telegraph.co.uk/news/politics/9842553/David-Cameron-given-a-lecture-on-debt-and-deficit-by-top-statistics-official.html

Sorry, couldn’t find the official video.

Jean-claude Juncker said “lie when it’s serious” ; it must be pretty serious then, everyone’s doing it.

Just under 3 billion euros of government debt is the result of three Labour blunders: the 8000 employed before the election by the desperate Labour government, the disastrous 22 months under Sant and the money flushed down the drain in the Drydocks.

‘Aktar ma ikollna dejn aktar inkunu sinjuri u l-finanzi ikunu aktar fis-sod’ George Orwell.