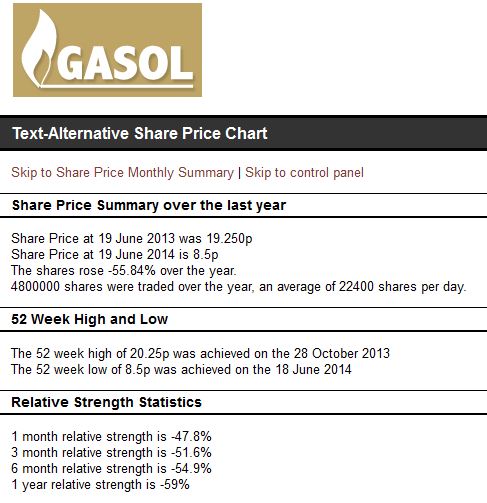

Lead power station contractor Gasol’s shares down to 8.5 pence yesterday from 20.25 pence last October

Published:

June 19, 2014 at 11:36am

10 Comments Comment

Leave a Comment

http://hsprod.investis.com/ir/gas/ir.jsp?page=text-chart

When BP’s – I repeat: BP’s – stock price went down by 50% in the aftermath of the Gulf of Mexico oil spill (June 2010), market analysts intepreted this as a sign of bankruptcy. BP had a market capitalisation before the oil spill of almost $200 billion, and assets comprising of oil and gas reserves around the globe.

http://business.time.com/2010/06/09/is-bp-headed-for-bankruptcy/

What are we supposed to conclude about Gasol’s share price drop of more than 50%?

Fenomenali.

Don’t worry, Joseph will save us because we believe in him.

The only thing that Joseph can truthfully say to himself, to his henchmen and to the Maltese is a simple four-word sentence:

“WE HAVE BEEN HAD”.

Obviously he will in no way indicate that it was he himself who brought this about

Gasol’s share price almost doubled around February/early March 2013 – only to fall ever since.

So did some people know about Gasol being the company that was going to benefit from Labour winning Malta’s election? Wasn’t it supposed to be by tender?

There was another particularly sharp decline some two weeks ago – share price has fallen some 50% since June 1st.

[Daphne – I had written extensively about that first bit last summer. If you use the search box on this site you’ll probably be able to call up much of the information.]

Right. Times of Malta should really get a grip and start asking some serious questions.

Mario de Marco? Not likely.

Malta has really become join-the-dot nation.

March 2013: Gasol obtains a 1,000,000 dollar loan from Azerbaijani state company Socar.

Gasol share price doubles.

Hey presto, and twelve months later, Leyla Aliyeva, daughter of the Azerbaijani dictator, is the President and government of Malta’s special guest.

4th June 2014: A group of 50 academics, most of whom were invited to the Shale Gas Summit in Edinburgh the following week, call on the UK government to go for shale gas.

13th June 2014: The EU sets aside 113 million Euros in subsidies for research on shale gas.

June 2014: Gasol’s share price drops.

June 2014: China starts outspending the US on shale gas research.

The share price of Gasol was at 13.75p up to 16 June, and went down to 9.5p and 8.5p on 17 and 18 June respectively.

The sharp drop reflects the news of cancellation of listing which was published on 17 June. The shareholders are selling their shares before it becomes very difficult for them to find a buyer, which is what will happen when the shares are taken off the market.

Still, the sharp drop in the price shows that the small shareholders do not put much value in the company.

At this point, once the company is taken off the AIM list, there is a strong possibility that the control ownership (African Gas Development Corporation Limited currently holds around 70% of Gasol) will be transferred to another owner, and this without the need to declare the transfer publicly to a market and to everyone.

This is in fact the time for Gasol’s main shareholder to sell off its stake. The company has now bagged a contract with Konrad Mizzi and if someone with the money comes along and is happy to take on the responsibilities that Gasol has assumed in its contracts, then the present owners can sell their interest.

Why else would a company seek cancellation of listing when it had just won a tender for the supply of electricity to a country that is effectively part of China?

So I am not 100% sure that this company was necessarily finding difficulty obtaining finance. It is likely that its majority shareholders were merely looking for someone who would be interested in buying their shares and controlling the company.

You could well be very right.

Here is the killer line from the Gasol press release concerning de-listing.

“due to the small size of the Company, many of the business opportunities that the Company is considering would constitute a Reverse Takeover under AIM Rules and would thereby incur extra time, cost and uncertainty in execution;”

It looks like they want to sell or merge the company.