Ninu Zammit is either lying or he made a deal with Labour (or both)

I have looked up the details of this government’s amnesty last year on undeclared assets held overseas. Like all such amnesties for large-scale tax-evaders over the years, it is not called by its proper name, but is instead called a “registration scheme”.

This is wrong because it allows those who have evaded massive amounts of tax, sometimes for decades as in the case of Ninu Zammit (and possibly Michael Falzon, who has yet to give details on which amnesty he used, if at all), to feel legitimate and validated.

But an amnesty is an amnesty is an amnesty, and the fact that they took advantage of it and are now in order does not obscure the fact that for decades they broke, on a large scale, the very laws they made as legislators and were in duty bound to uphold as cabinet ministers and, in Falzon’s case, the chairman of a state corporation.

They are in exactly the same position – morally – that George Farrugia is. They have been given an amnesty in return for doing the state a favour: in this case, bringing their money to Malta and paying 7.5% of its worth into the state coffers so that the government can pay some bills with it.

In return, they will not be penalised or punished or financially crippled for the massive tax evasion they perpetrated for, by their own admission, up to four decades. They will also be able to move their money around and use it freely, instead of hiding it.

Now let’s get back to Ninu Zammit’s specifics, as laid out in his statement yesterday. He said that he began depositing money “overseas” in the 1970s and carried on over the years since. He said that he got the money from professional work and from property transactions.

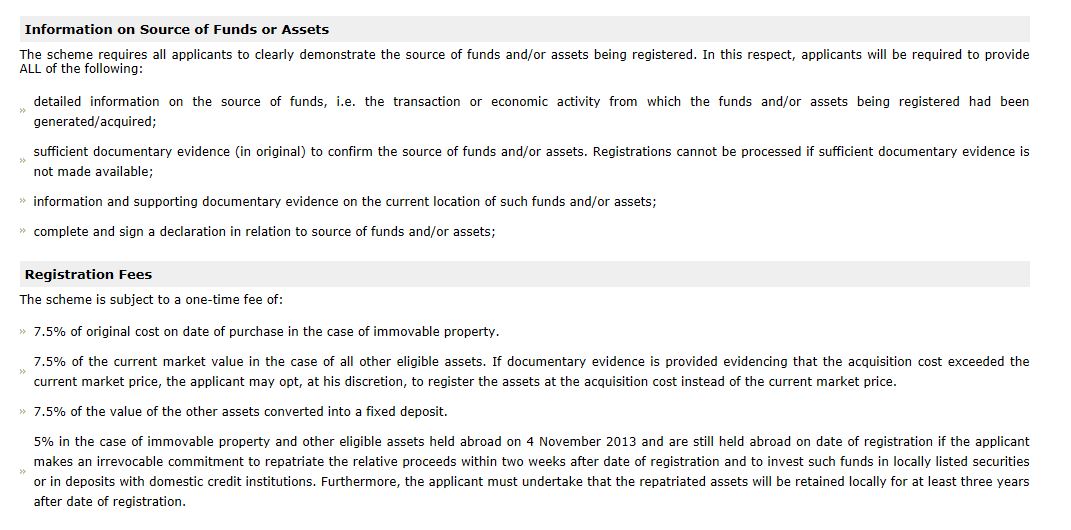

From the website of a reputable financial services consultancy, I obtained the conditions for this scheme (they are in the image uploaded below). The conditions are quite specific:

The scheme requires all applicants to clearly demonstrate the source of funds and/or assets being registered. In this respect, applicants will be required to provide ALL of the following:

detailed information on the source of funds, i.e. the transaction or economic activity from which the funds and/or assets being registered had been generated/acquired;

sufficient documentary evidence (in original) to confirm the source of funds and/or assets. Registrations cannot be processed if sufficient documentary evidence is not made available;

information and supporting documentary evidence on the current location of such funds and/or assets;

complete and sign a declaration in relation to source of funds and/or assets;

There is absolutely no way on earth that Ninu Zammit will have been able to prove the source of funds deposited in the 1970s and 1980s which, as he claims, he made through professional work. He will not have kept invoices and documents for 30/40 years even if they existed in the first place, in those years when people used to operate in an invoice-less economy (pre-VAT, remember).

With property, he will have had the contracts – but the jury is out on that too.

Ninu Zammit is either lying about how he got to have a very, very large sum of money at HSBC Geneva, or we have to conclude that he is yet another on a lengthening list of shady individuals who struck a deal with Labour in advance, in return for being useful to the Labour Party or its fellow travellers (not necessarily in party politics) at some point.

How do I conclude that Zammit was evading tax on a very, very large sum of money? Simple: Michael Falzon said how much he had concealed – around half a million euros. If Zammit’s hidden funds were anywhere around that amount, or less, or only a couple of hundred thousand more, he would have said “I’ll say how much it was, like Michael did.”

The fact that he has refused to say how much he hid from the tax authorities, his prime minister, parliament and the public while he was a cabinet minister tells you the obvious: it is an eye-watering sum that will change the game completely.