This is how money is funnelled out of the country and laundered

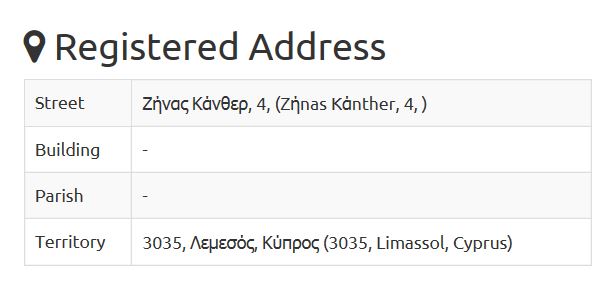

The screenshot of text is from the article about Malta/the Panama Papers in the Australian Financial Review last Sunday. The company details are from a Cyprus company-search portal, and show that A2Z Consulta’s true ownership is hidden behind nominees.

So this is what appears to be happening here: Redmap Projects Ltd gets a big (possibly government) contract for work – quality checks and so on. It ‘subcontracts’ the job to the tune of €900,000 to a A2Z Consulta Ltd, registered in Cyprus and whose real owners are concealed behind nominees. These real owners may be the same as those of Redmap Projects Ltd or they may be people in government or linked to the government – or both.

A2Z Consulta Ltd in turn ‘subcontracts’ the job to Blue Sea Portfolio, registered in the British Virgin Islands, which is now owed €978,000.

The job is undertaken by Redmap Projects, the Malta company, all along – but when it receives payment from the government, it pays the money out of money to the mysterious A2Z Consulta in Cyprus which in turn moves the money to Blue Sea Portfolio in the British Virgin Islands, always against invoice for ‘subcontracting’.

The award of the job or tender may itself be corrupt: a job or tender created for no reason other than to assign a large sum of public money to X or Y, a method devised by individuals in government, with the help of friends outside government, to embezzle public money through the structurally legitimate systems of tender/direct order/payment against invoice to Malta company. The money is then funnelled along and ends up in their own pockets and the pockets of their collaborators.

Redmap Projects in Malta deducts the sum it pays to A2Z Consulta, so it is liable for tax only on the difference between the sum it receives as payment from the government and the sum it moves along to A2Z Consulta, and the money moves along in this fashion until it ends up in the BVI, still owned by one or more of the same people who own the original invoicing company.

You should note that Blue Sea Portfolio was set up in 2013 by Nexia BT and the shares, hidden behind nominees, are in four blocs. The Australian Financial Review has linked Pierre Sladden to ownership of one of the blocs but the other three remain mysterious.