Zhongtian Liu: the Chinese aluminium billionaire who is now a Maltese citizen and has been given the vote in Maltese general elections

Zhongtian Liu, 52, is one of the many people who have bought Maltese citizenship, and who have applied for the vote. He is now on the recently published updated electoral roll. Despite his claim that he spent six months in Malta, he has done nothing of the sort. Liu lives between China, where his aluminium products business is based, and the United States of America.

He is a Chinese citizen and China does not permit its citizens to hold two passports or dual nationality. Yet he is unlikely to have given up his Chinese citizenship, as that is where his business is based.

Liu has not even bothered to pretend that he spends any time in Malta at all, not even for flying visits, because the address he has given to the authorities is one that is clearly of convenience, and not a billionaire address: an anonymous small flat in Naxxar, of the sort where newly-marrieds might live as their first home.

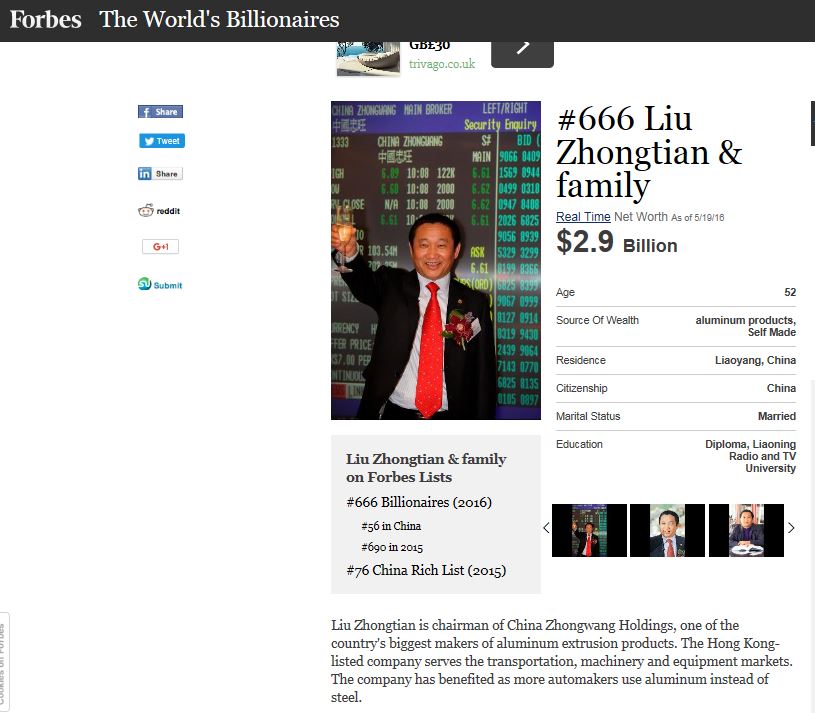

He is chairman of China Zhongwang Holdings, one of the country’s largest manufacturers of aluminium extrusion products. The company is listed in Hong Kong and serves the transportation, machinery and equipment markets, seeing a surge in revenue as more car manufacturers begin using aluminium instead of steel. This growth has led to his being ranked no. 666 on Forbes list of billionaires and no. 76 on the China Rich List. His net worth is $2.9 billion and we are expected to believe that he lives in a small flat in Naxxar and has a special interest in voting for candidates of the Labour Party, the Nationalist Party or Alternattiva Demokratika on the eighth district.

The South China Morning Post reported last August that Liu and his family had been siphoning off money from China Zhongwang Holdings, which raised HK$9.8 billion from an initial public offering in Hong Kong in 2009. The allegations were made by Dupre Analytics in a 51-page report. Zhongwang suspended its share trading and issued a statement throught the Hong Kong stock exchange saying that the allegations were “groundless” and that its external auditors had never cast doubt on its financial statements since its listing.

But Dupre said that Liu and his family were committing “the largest and most complex China fraud ever uncovered” and that they have “systematically defrauded investors, [fabricated] at least 62.5 per cent of revenue since 2011 and likely skimming billions of [capital expenditure] from the delayed [production facility] in Tianjin”. Dupre alleged that Liu and parties related to him took out some HK$36.5 billion in loans from mainland banks, and used the funds to buy Zhongwang’s aluminium products since 2011.

“The truly remarkable thing about this fraud is that the Liu entities [on the mainland], including the undisclosed related party suppliers [Liu] secretly owns, have been able to secure over HK$17.25 billion in net borrowings from [mainland] banks,” Dupre said. “None of these entities are remotely this creditworthy, and the clear implications are that the loans are ultimately recourse to Zhongwang.”

Dupre’s report claims that Zhongtian Liu has set up a secretly owned re-melting facility in Mexico which has allegedly imported HK$16.3 billion of aluminium products made by Zhongwang since 2011, and turned them into aluminium billets. But it has only been able to sell some HK$7.5 billion worth over three years. This essentially amounts to a reversal of the production process of Zhongwang’s facilities in Liaoyang, Liaoning province, which turns billets into extrusion products used in construction, transport and industrial applications.

“It’s like taking a new car, melting it down, and selling it as steel,” Dupre said. Its report contains a photograph of what is purportedly the Mexico facility. Dupre says that Liu and his family have been selling the re-melted aluminium for below its purchase price, which means they “will have to absorb losses” to the tune of HK$7.7 billion if they have to repay the loans. “If Zhongwang is on the hook for these loans as we believe, it could be insolvent,” Dupre said.

Dupre also alleged Liu imported HK$4.4 billion of aluminium products from Zhongwang to his facilities in the United States, including two warehouses in California. Separate operations in Malaysia controlled by him have imported HK$10 billion worth of Zhongwang’s products, while operations in Vietnam received HK$20 billion worth of products, according to Dupre.

In a recent article, International Policy Digest wrote: “Even before the Panama Papers became front-page news, questions were raised about Liu Zhongtian, chairman of aluminum company, China Zhongwang Holdings, who had laundered tens of millions through odd transactions. According to a report, Liu and his family were committing “the largest and most complex China fraud ever uncovered.”