Penthouse sold to taxman Ivan Portelli at €49,000 less than purchase price 2.5 years earlier

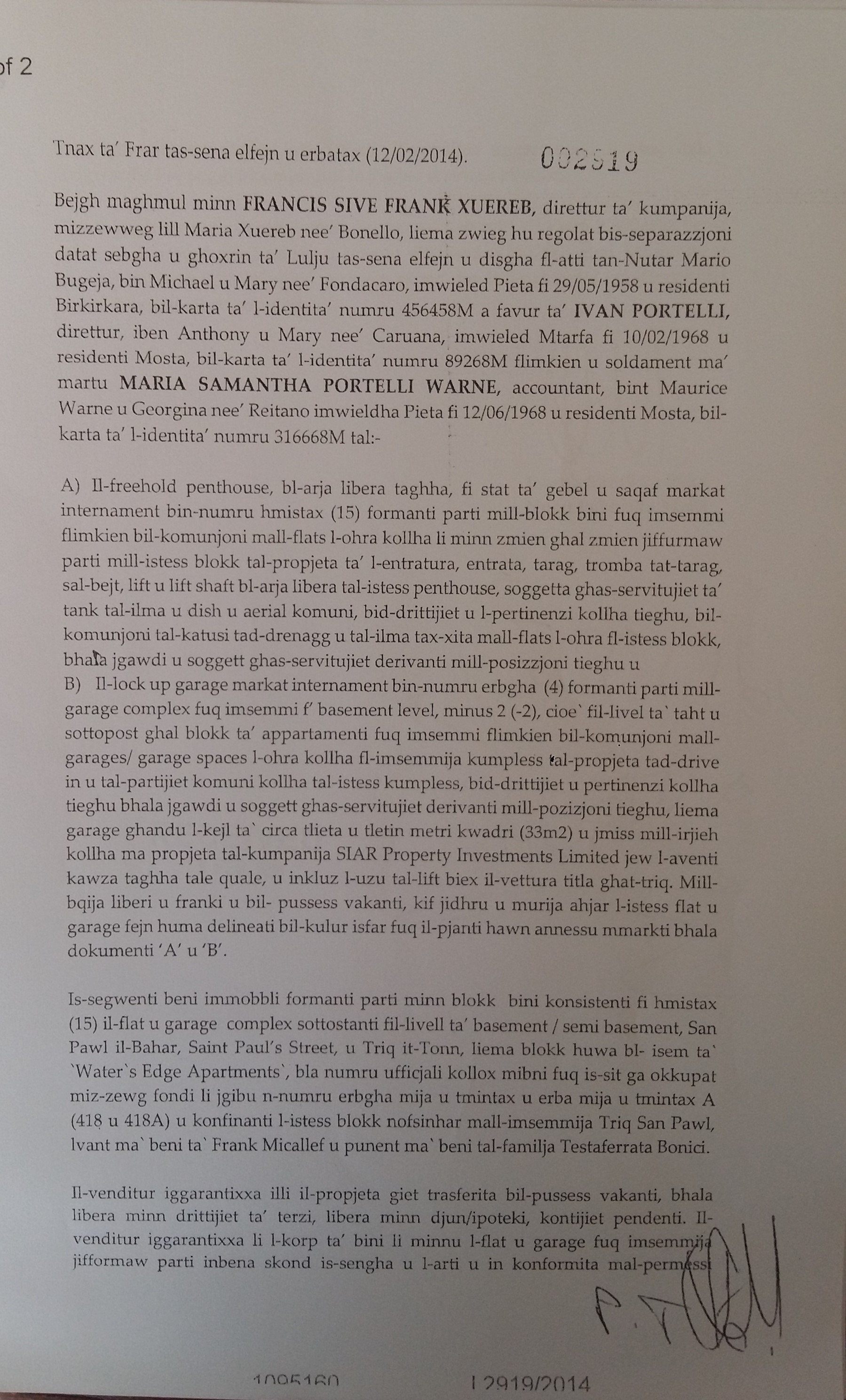

On 12 February 2014, just six weeks after being appointed Director of Operations at the Office for the Comissioner of Revenue (VAT), Ivan Portelli bought for €300,000, from Frank Xuereb, the St Paul’s Bay penthouse flat in which he and his family now live, and a garage in the same block.

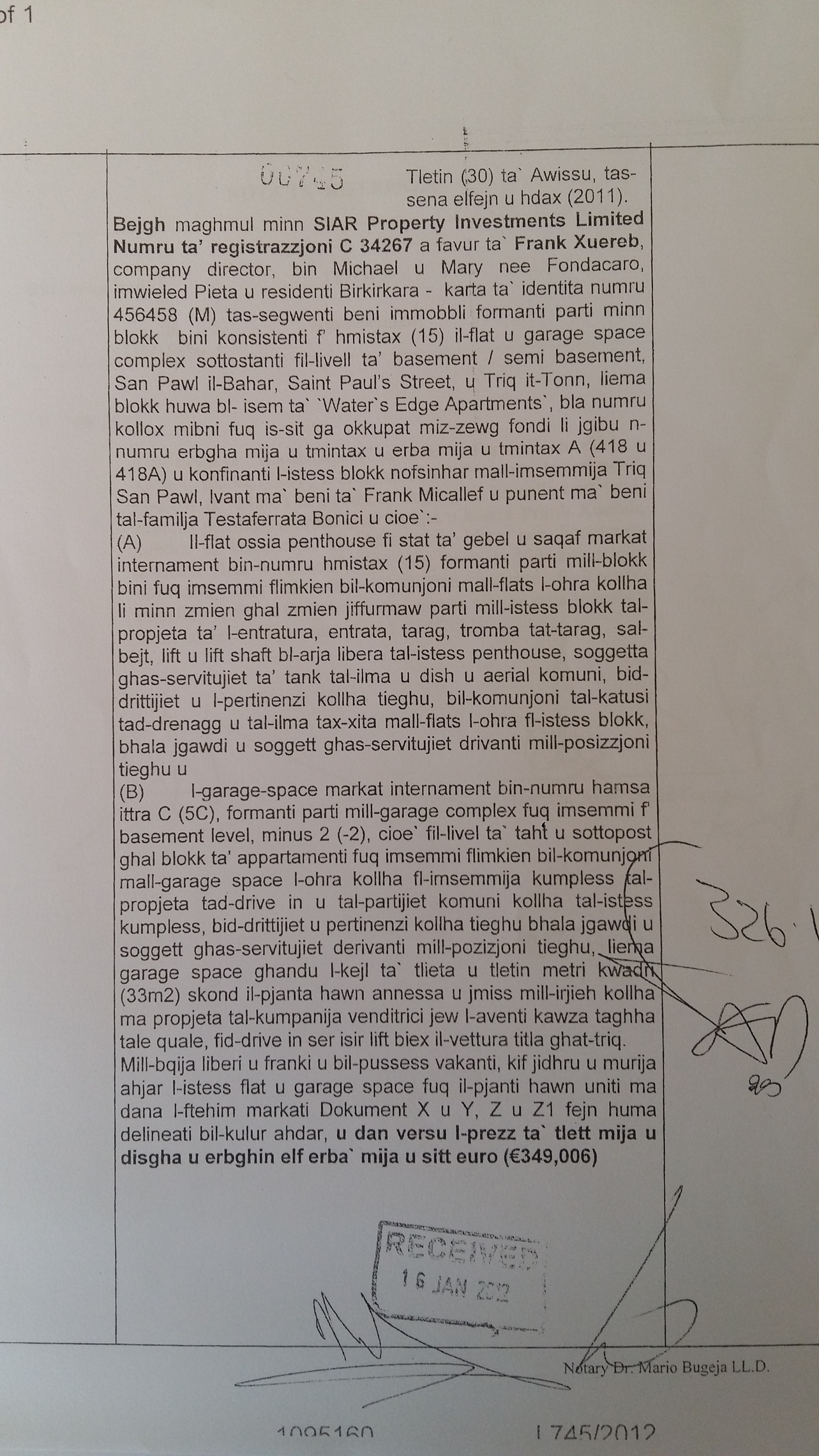

Xuereb had bought the penthouse and garage from Siar Property Investments Ltd just two and a half years earlier, on 30 August 2011, for €349,000. Siar Property Investments Ltd is wholly owned by Silvio Debono and Arthur Gauci (who is also CEO for the DB Group) in their personal capacities. Its registered address is the Seabank Hotel. The company had developed the entire block of flats at that address, and Xuereb’s company, Xuereb Installations Ltd, had done the finishing works.

Though sources told this website that Siar Property Investments used the penthouse to pay Xuereb Installations Ltd for its finishing work, the contracts are in Frank Xuereb’s personal name. The contracts also describe the penthouse as being in shell form (unfinished) when Xuereb acquired it, and still in shell form when he sold it to Portelli two and a half years later.

UPDATE: Xuereb will have lost more than €49,000 on the sale, because he will have had to pay capital gains tax on the transaction. In 2014 capital gains tax would have been 7% to 10%. The law allows for exceptions to be made where certain circumstances force the sale. In such cases, with Inland Revenue approval, you would pay just 1% capital gains tax. Frank Xuereb paid 1% when he sold to Portelli “in terms of Article 43 (3) of the Income Tax Act. The authorisation for the capital gains exemption is appended to the contract.

In situations where a piece of real estate is bought for €349,000 and then sold for €300,000 less than three years later, the transaction would ordinarily be red-flagged at the Inland Revenue’s Capital Transfer Duty Department. This is the department in Merchant Street, Valletta, where Portelli used to work before being appointed Director of Operations for VAT. It was he who handled cases of under-declaration of real estate contract value and contested them in court for the Department.

In this case, the significantly lower declaration of value appears to have gone by unchallenged by the Department which Portelli had left only six weeks before the transaction took place, to the point where approval was also obtained for the exceptional 1% capital gains tax.

Ivan Portelli bought this penthouse flat six weeks after being appointed director of operations (VAT) for 300,000 euros, from a company owner who had bought it for 349,000 euros two and a half years earlier.