BREAKING/Malta Financial Services Authority banking inspectors refuse to carry out inspection at Pilatus Bank; one inspector resigns

Banking inspectors at the Malta Financial Services Authority – Malta’s regulatory and licensing authority for banks – are refusing orders by their superiors to carry out an on-site inspection at Pilatus Bank.

The bank is at the epicentre of a scandal involving suspicions of money-laundering, and is also the related subject of an inquiry by Magistrate Aaron Bugeja, which is primarily into the ownership of Egrant Inc, the third company set up in Panama in tandem with those owned by Konrad Mizzi and Keith Schembri, the Prime Minister’s chief of staff.

The banking inspectors – two senior inspectors and five junior inspectors – received instructions from their superiors on 31st May, three days before Malta went to the polls in a general election, to go to Pilatus Bank and carry out an on-site inspection. This was when the bank was still under investigation by court-appointed experts under the direction of Magistrate Bugeja.

Sources at the Malta Financial Services Authority have informed this website that all seven banking inspectors were unanimous in refusing the instructions, putting themselves at risk of disciplinary action for insubordination.

Late last Friday, all seven inspectors received an email from a senior MFSA executive, giving them an ultimatum: they either inspect the bank on site, or they inspect, in their own offices, files which Pilatus Bank would deliver to the MFSA. The inspectors refused, pointing out that if the bank is allowed to choose and deliver files for inspection, it would deliver only ‘clean’ files.

Faced with this ultimatum, one of the inspectors – Mario Felice – resigned on Monday. Mr Felice could not be reached for comment.

The banking inspectors gave as the reason for their refusal to inspect the bank on site the fact that they themselves are under investigation in a separate magisterial inquiry – led by Magistrate Consuelo Herrera – into how a Financial Intelligence Analysis Unit report about Pilatus Bank reached the press.

The banking inspectors, sources said, told their superiors that it would not be appropriate for them to conduct an inspection at the very same bank at whose request they are being investigated themselves.

The same sources have told this website that the FIAU report about Pilatus Bank, which was leaked to the press, was accessible to around 50 members of staff at the Malta Financial Services Authority, “including the entire banking unit, of course, all of whom were summoned en masse before Magistrate Herrera and grilled about whether they saw it, downloaded it or printed it, including a heavily pregnant member of staff who had been on maternity leave at the time”.

Divulging the report to the media exposes staff members to heavy fines and a prison sentence.

The Malta Financial Services Authority had received that report from the Financial Intelligence Analysis Unit last year. During an on-site inspection at Pilatus Bank in March that year, the FIAU had found evidence of suspicious transactions and had alerted the MFSA accordingly.

The Malta Financial Services Authority, sources told this website, was initially in a quandary as to how to handle the situation, but then dropped the matter when Manfred Galdes handed in his resignation as director of the FIAU. Dr Galdes resigned shortly after presenting separate reports on the offshore activities of key government officials to Police Commissioner Michael Cassar, who resigned within 24 hours citing health reasons. He was replaced by Lawrence Cutajar, who took no action.

Sources told this website that the real reason the Malta Financial Services Authority’s banking inspectors are refusing to carry out an inspection at Pilatus Bank is that they fear they are going to be used in a whitewash operation which will see the bank being given a “clean bill of health” which it will then use to its own advantage.

“They suspect that there may be collusion between topmost officials at the Malta Financial Services Authority and Seyed Ali Sadr Hasheminejad, who owns the bank. If there is such collusion, then the bank will have had ample time to clear the decks before the inspectors move in,” the sources said.

“The feeling is that the pressure for the inspection is actually being exerted by the bank on the MFSA executive, rather than the other way round, and that this is happening because Mr Hasheminejad wants some kind of ‘good conduct certificate’ for his bank that he can use for his purposes.”

It was the Malta Financial Services Authority’s banking unit which originally alerted the Financial Services Authority to suspect activity and processes at Pilatus Bank, the sources said. “Neither organisation wanted to handle the matter at first, but then it was decided that the FIAU would do so because it looked like money-laundering, which is the FIAU’s remit,” the sources said. “The bank’s business model makes no sense at all.”

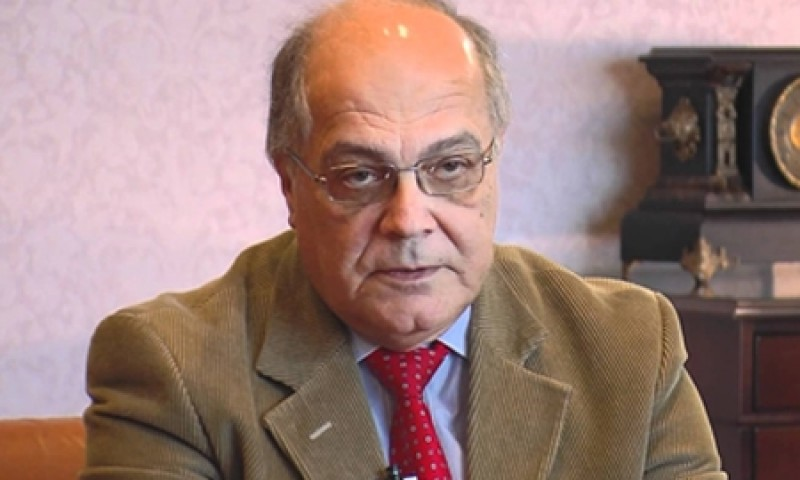

The chairman of the Malta Financial Services Authority, Joe Bannister, has not commented publicly on the ongoing controversy. He was seen in the company of Seyed Ali Sadr Hasheminejad, owner of Pilatus Bank, at Frankfurt airport last week. They took the flight back to Malta together.