So what sort of Ponzi scheme did Edward Banayoti run when he was called Ernest Anderson?

I’ll quote directly from the Ontario tribunal documents, and you can read more here: set_20090925_andersone

Anderson is an individual who resides in Ontario. Anderson was the owner and the signatory and/or an officer and director of the Golden Gate entities described below from December 31, 2003 until at least October 1, 2008 when GP Golden Gate Ltd., the general partner, was assigned into bankruptcy. In or about February 2009, Anderson became the founding Chairman and managing director of the Berkshire entities also described below.

Anderson has never been registered in accordance with Ontario securities law. Golden Gate Funds LP has never been registered in accordance with Ontario securities law and has never been a reporting issuer in Ontario.

Golden Gate Funds LP has never filed a preliminary or final prospectus with the Ontario Securities Commission and receipts have not been issued for them by the Director.

Berkshire Capital Limited is a company incorporated in the Republic of Panama (…) Panama Opportunity Fund is purported to be a fund wholly owned and operated by Berkshire.

Anderson and Golden Gate Funds LP traded in approximately $4,644,258 worth of Golden Gate Funds LP securities in breach of the prospectus and registration requirements of Ontario securities law. Contrary to the Golden Gate Limited Partnership agreement, investor funds were not used to purchase an investment portfolio of mortgages. Investor money was transferred from Golden Gate Funds LP to the bank accounts of other related companies, used to pay operating costs for Golden Gate Funds LP and other related companies used to pay monthly interest payments to other investors and used to repay investors from a previous investment scheme operated by Anderson.

In February or March of 2008, Anderson moved to Panama where he started a similar business offering a new investment called the Panama Opportunity Fund.

And this is from a report on CTV News , dated 24 April 2010:

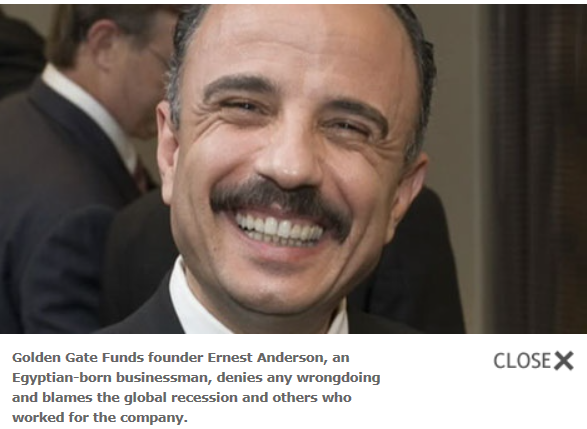

Golden Gate Funds was founded by Ernest Anderson, an Egyptian-born businessman with a flair for raising funds and flattering political friends. He claims a PhD in economics from Columbia University, a degree W5 has been unable to verify. Living in a $4-million, 7,000 square foot mansion, north of Toronto, Anderson denies any wrongdoing and blames the meltdown on market circumstances and on others who worked at Golden Gate.

But Milton Chambers, a lawyer Anderson hired as Golden Gate’s in-house counsel, says this isn’t a case of gullible seniors making ill-informed investment decisions. “They were taken in the same was I was taken in,” said Chambers.

Chambers joined Golden Gate after Anderson invited him to a high-profile party for Paul Martin, Prime Minister from 2003 to 2006. Anderson and his wife made large political donations to the Liberal Party, at least $10,000 in 2005 alone. He courted Conservatives as well, attending fundraisers and hiring high profile members of both parties. Milton Chambers believes those kinds of connections impressed investors, and lent sparkle to Golden Gate as the investment fund attracted investors.

In 2007, the company took out an ad in the Globe and Mail, announcing a new high-profile Board of Directors, including former Prime Minister John Turner, former RCMP Commissioner Norman Inkster, and former Conservative Cabinet Minister John Reynolds. W5 contacted all three to confirm that they were directors of Golden Gate. They denied that they had ever agreed to sit on the company’s board.

I have made further enquiries about Milton Chambers – he has since been disbarred, no doubt as a result of his involvement with Ernest Anderson/Edward Banayoti. The report continues:

The Ontario Securities Commission – the agency that monitors and enforces investment laws – first opened an investigation when Golden Gate began marketing its funds to the public, as far back as 2005.

Ads claimed Golden Gate Funds was an investment in mortgages, promising eight percent annual returns with almost no risk to the principal. In a series of letters, the OSC demanded Golden Gate comply with securities law by registering with the OSC, filing a proper prospectus and begin reporting its operations. But that never happened. And because of the OSC’s privacy rules, investors were never warned of Golden Gate’s status.

In January 2009, after the collapse of Golden Gate, about four years after its investigation began, the Ontario Securities Commission launched formal hearings against Ernest Anderson and Golden Gate. A Commission investigator told the hearing it “looks as though a certain amount of funds were spent on Mr. Anderson’s lifestyle, for his personal expenses…it’s our understanding Mr. Anderson did lease a Porsche, a limousine and a Bentley.”

In a joint Settlement Agreement signed with the Ontario Securities Commission in September 2009, Ernest Anderson admitted there were no investments in mortgages.

Golden Gate’s former in-house counsel, Milton Chambers told W5, “It appears as if all of the money was used in the classic Ponzi scheme – in which new investors were paying out old investors. Or it was used to pay the ongoing expenses of the company for a period of three years.”

The OSC ordered Ernest Anderson and Golden Gate Fund to pay nearly $4.8 million in fines and fees. There is no indication any of the investors have been repaid.

In an e-mail to W5, Ernest Anderson wrote, “What went wrong, market conditions, miss organization (sic) at the time I left the company to by ran by other (sic) while I had to deal to some personal issues.”

In a later statement Anderson also said: “I am very sorry for all of the investors who lost money with Golden Gate, I am sorry, that my family lost all of the life savings and inheritance in Golden Gate.”

W5’s investigation also uncovered some troubling information about Mr. Anderson’s past. In 2005 he was convicted of sexual assault relating to incident which took place at Golden Gates’ offices. He also has civil court cases and judgments totalling more than a quarter million dollars against him.

W5 has learned law enforcement agencies are aware of the Golden Gate Funds failure. The OSC says its investigation of Golden Gate and Ernest Anderson remains open but offered no further details.