Delia has been living off credit cards and overdrafts/has no money to speak of unless hidden/personally owes almost €1 million

The man who public sentiment indicates will be leader of the Nationalist Party tomorrow, but not of the Opposition, has published his statement of affairs at the 11th hour, its shocking contents answering the question of why he first refused to publish and then delayed until the last possible minute.

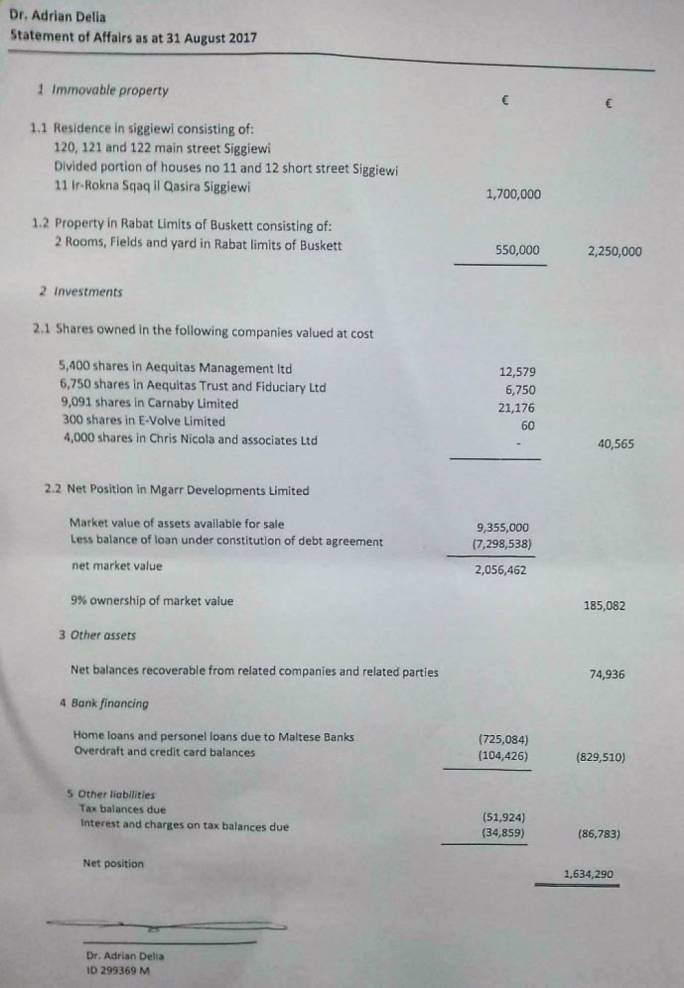

Delia, who has a financially dependent wife and five children at one of Malta’s most expensive independent schools, San Anton School, where he has to pay tuition fees and book/uniform costs of around €26,000 a year, has been living off credit cards and overdrafts at different banks. At this point, he owes the banks €104,000 on his credit cards and his overdrafts.

He also owes the banks €725,084 in personal loans, bringing his personal debt to the banks to a current total of €829,510. This will be increased further as he continues to draw on his credit cards and overdraft to meet his daily living expenses and other debts. Delia told the press in response to a specific question this afternoon that his total overdraft limit is €190,000. This is not on one overdraft but on overdrafts at different banks.

The annual interest on his personal loans alone – excluding interest on his credit card debt and overdrafts – is €43,600 a year. His children’s school bills and bank interest alone come up to a minimum of €70,000 a year. The Opposition leader’s salary is just €43,000 – but Delia needs a seat in parliament to allow him to take the oath as Opposition leader to get even that.

Outstanding income tax, penalties and interest on unpaid tax bring the total of Delia’s personal debts – or rather, those he has declared – close to €1 million. He owes tax of €51,924 for an unspecified period, on which penalties (described disingenuously in his published document today as “charges) and interest of €34,859 have been levied.

The fact that the penalties and interest are so high compared to the amount owed indicates that Delia was subject to an assessment for undeclared income. Penalties are levied only when income is not declared in income tax returns and the Inland Revenue raises an assessment. Journalists at the press conference did not ask him about this, perhaps because they are unaware that charges are in fact penalties and that penalties are levied only when income is not declared to the authorities or is declared late.

Delia has meanwhile resisted all calls to publish his recent income tax returns.

His immovable assets, as declared in his statement of affairs, comprise the house in which he and his family live and two rooms in a field, which are familiar to me because they were bought from somebody I knew. They have no building or development permit and are unlikely to get one because they are located in Buskett. The valuation of €550,000 is extremely optimistic.

Delia’s only other declared assets are shares in various companies which are valued at a total of just €40,565. Even if he finds somebody to buy them, and at that price, the sum is not even enough to cover a year’s interest payments on what he owes the banks.

Meanwhile, the unsold flats at Mgarr in Gozo have been optimistically valued at €9.4 million. Even if they are sold for that total sum in the remaining 16 months before HSBC forecloses on the deed of constitution of debt signed last July, this will leave Delia with just €185,082 as his share of the ‘profit’ after the bank takes its €7.3 million – a paltry return for a building development project that took 13 years and millions in risk. In other words, a failed business venture.

When journalists at the press conference asked him how he plans to pay even his daily living expenses let alone pay back the close to €1 million he owes the banks personally, on an Opposition leader’s salary of just €43,000 a year, Delia said he is owed money himself. His statement of affairs shows this to be just €74,000 – enough to pay for a year of school expenses and bank interest.

One newspaper quoted him as saying: “As I have said, I am going to dispose of my assets. That disposal will give me an amount of money which we will spread with the help of technical people to make up for the difference in income.”

But the only assets he has to dispose of are €40,565 worth of company shares, the house in which he and his family live, and the two rooms in a field in Buskett over-valued at €550,000. Unless he sells the family home, he can’t pay his personal debts of €1 million.

And once he has sold the family home and paid back the banks, he will still need to find somewhere to live and a source of income to meet his sky-high living expenses.