Right. Now questions really do have to be asked, and answered – in parliament if necessary

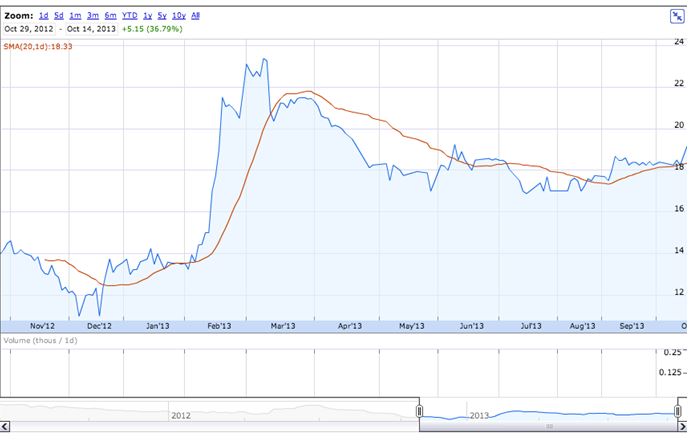

This graph plots the fluctuations in Gasol’s share price. Gasol holds 30% of the consortium which has won the power station bid.

The share price rockets – quite literally a vertical trajectory – in the run-up to Malta’s general election. The price actually peaks in the first 10 days of March.

After that, it begins to dip but steadies out at a far higher level than prior to the ‘Malta’ factor.

Of course, there are such things as coincidences, and they are quite marvellous, but we might well be looking at something altogether different here.

It’s not as though suspicions weren’t raised already by the fact that Gasol is capitalised at just £6.2 million – a minuscule amount for involvement in this line of work – and has something like 10 employees.

If there is no credible alternative explanation for this sudden explosion of interest in Gasol shares in February and March this year, then we shall have to consider the possibility that Gasol knew something back then that was kept hidden from the Maltese electorate.

This would mean that the entire tender process has been a complete sham, with the outcome a foregone conclusion as far back as January, when Labour announced its ‘roadmap, kosted u konkret’ for Malta’s power supply. That would be why Labour was so sure of what it was going to do, down to the numbers.

58 Comments Comment

Leave a Comment

The Stock Market upon which `Gasol` is listed has the will and the ability to investigate any unusual price fluctuations – the article shows that this may have been pure coincidence but it is possible, indeed likely, that there has been insider trading – a criminal offence in the jurisdiction of the stock market listing. This investigative route is likely to bear fruit if there has been criminal actions.

The European Union also has the investigative powers to deal with the Malta Governments sham tender.

This website is the only mechanism in Malta currently with the will and ability to highlight and confront the Labour regime in power.

Does anyone really think the EU isn’t coming down on this like a ton of bricks?

That’s the plan, always was.

The reins of power in Malta are in the hands of `pimps, thieves and scoundrels`

What about the due diligence report on this Gasol? The company’s experience in handling such large and important projects is of huge importance to Malta. A company with no relative history and experience to write home about cannot be trusted for our energy supply.

What about the extremely low equity. How can a small company like this handle an energy project worth hundred of millions without overtrading from the word go?

When the real giant Edison, ExxonMobil and Qatari holdings pulls out of this relatively smallish sized project but with major implications for its overall strategy, rest assured the opposite of due diligence happened.

Projects of this scale are political, Labour turned its back on the European strategy. So Muscat wants to sit at the negotiating table owning available ‘infrastructure’ in future, one asks at what price.

I dread to think what the Chinese will demand to protect their investment, Gasol’s a facade.

For starters I’d ensure no one else gets to govern this place. Wouldn’t have anyone deciding anything other than Labour.

This explains the disappearance of the professional and really international companies that showed interest in this Konrad Project.

We still have to see the Chinese slice in this consortium.

I’m starting to smell the coffee now.

Yes, and it’s more than a little bit off.

Malta is not within Gasol’s usual geographic remit. Gasol operates in West Africa, not within the EU, or even within the Mediterranean area.

http://markets.ft.com/research/Markets/Tearsheets/Business-profile?s=GAS:LSE

The Company is an African-focused gas company engaged to develop its own sources of gas, as well as gas to power projects. Gasol also intends to purchase stranded gas assets in Nigeria and other countries along the Gulf of Guinea. The Company’s primary geographic focus is the Economic Community of West African States (ECOWAS), together with Mauritania.

That’s parallel to China’s strategy in africa.

Let’s zoom in.

And out.

Very interesting.

Short and sweet:

Finance

In March 2013 Gasol issued $20m of bonds to a group of investing institutions to

back its West African plans. There is a further $80m which can be issued in this

way.

A cautious view would suggest that an injection of equity will need to be made at

some stage, with resultant dilution for existing equity shareholders.

http://www.gasolplc.com/media/18640/malta_141013.pdf

Can we know who are these ‘investing institutions’? And te following is also from their website:

“Malta is not a side issue. It is a major initiative which should transform the

market’s perception and valuation of Gasol

Gasol’s main objective remains the development of facilities to supply gas to the

West African countries of Benin, Togo and Ghana, where it is desperately needed.

Gasol will supply an FSU + regas for supply of gas via the 678km WAGP. Volumes

are expected to be up to a maximum of 430mmscf/d.”

Is Malta a side issue or not?

Gasol has pulled that press release.

Who’s going to take bets that a link will surface before long between this power station business and Dalli’s Bahamas trip for a charity project in Africa?

It will be charity if this new gas route is parlayed by using the new citizenship schemes for Nigerians and other West Africans on the one hand, Libyans and Sudanese etc on the other who are facing tighter controls across most other European countries, and, as Daphne highlighted, would be normally found trading in London when not at home and requiring easy travel arrangements.

They don’t need 400,000, just a steady 18,000 lead.

So the government claim that Siemens is the biggest shareholder of the consortium, with 20%, is false.

We are entering a season of corruption on a scale we have never witnessed before. The present Labour bunch make Lorry Sant look scrupulously virtuous.

The Minister of Transparency, Konrad Mizzi, said that “Siemens are involved as lead developers with a 20 percent stake,” according to timesofmalta.com.

http://www.timesofmalta.com/articles/view/20131013/local/gas-bidder.490079

Without any shadow of doubt, 20% is not a majority stake. And since GASOL plc has 30%, Gasan Tumas have another 30% and SOCAR has 20%, then Siemens is not the biggest shareholder.

But this information needs closer analysis, as usual.

1. I cannot understand how Siemens, a German and global giant, would join a consortium with a minimal stake of 20%, while another little company called GASOL plc, worth £6 million on the London Stock Exchange’s Alternative Investments Market, holds a stake of 30% in the consortium.

At the same time, we are told that Siemens will be the lead developer. But that does not mean that GASOL cannot tell Siemens “My banana is bigger than yours” (to quote Toni Abela, the deputy leader of the Malta Labour Party, who sits on Cabinet meetings, and who provides legal services to the “Ministru tal-Faqar” as Marthese Portelli of the PN aptly described Marie Louise Coleiro Preca on radio yesterday).

2. I believe the Minister of Transparency Konrad Mizzi when he says that Siemens will take the lead development of the project. In fact, Siemens is the company that will supply the new power plant which will add new capacity of 200 MW at Delimara. It will probably also lead the conversion of the BWSC plant to gas by supplying further technology.

According to Konrad Mizzi, this should all be done within 2 years from 9 March 2013.

But Siemens’ Energy division is in the business of developing and installing plants. It is neither in the business of running power stations, nor in the business of entering into long term power supply agreements. And it is not in the business of guaranteeing gas and power prices.

Therefore, I cannot see Siemens staying in this consortium for more time than is necessary to develop, install and commission the new plant. 2 years, according to Konrad Mizzi.

Who will replace Siemen’s 20% stake in the consortium after that period?

This probably also explains why payment for the plant must be guaranteed. Because Siemens will be providing the plant, and it is highly unlikely that it will be staying in the business thereafter, and it will want to be paid as soon as the plant has been commissioned.

This probably explains why Siemens accepted a 20% stake. That stake is likely to be held for a couple of years at most, and as long as it is guaranteed the payment for the equipment supplied, that 20% is just symbolic.

3. We are told that Gasan and Tumas jointly have 30%. What is the proportion between them? Does this mean that they have an equal share of 15% each?

And yet PN was so so negative and the electorate so so blind. I believe more than ever now that PN really did have foresight but alas we ALL have to suffer the consequences now.

PN was not negative, it was realistic, ie it knew what it was saying.

The electorate was being optimistic by buying into a pie in the sky story, and this is the result

Well, parliament is the only place it can happen. The press sucks, the police and the AG won’t do anything as has now been established by the Dalli precedent so parliament is the only place left for it.

But if it were the case, can you really see a Labour majority parliament and PAC coming to the conclusion the the Minister for Energy and his party colluded with a private company to circumvent procurement laws.

What I’d REALLY like to know is what connections, if any, Shiv Nair has to the component parts of this consortium, who has he met and when, etc.

And John Dalli too, don’t forget him and his energy plans

So, the ElectroGas Consortium is Siemens (who will build and operate the power station), SOCAR (who will supply the gas and storage ship), Tumas & Gasan (who are there as local agents and investors I guess).

What is Gasol there for? To provide the regasification unit? They are doing this on their Benin project but it’s actually their partner (SOCAR – them again) who will actually ‘assist’ i.e. provide the equipment.

And this company is only valued at GBP 6.2 million, yet it is participating in two LNG projects (as lead partner) worth upwards of USD500 million. The Gasol press release actually states that the company’s future is linked to the Malta project.

This company is still very small and openly admits it will need a fresh capital injection. It looks to all intents more like an investment vehicle that partners up with larger companies which will bear risk.

You might want to look more closely at the Gasol-SOCAR LNG project in Benin as I suspect that the Malta project has been modelled on it:

Capex for Benin is 380 mill dollars financed on 80% debt, 20% equity.

Capex for Malta is 370 mill euro financed on 80% debt, 20% equity.

Gasol and SOCAR are involved in Benin.

Gasol and SOCAR are involved in Malta.

SOCAR are providing the LNG and storage in Benin.

SOCAR are providing the LNG and storage in Malta.

Build and commissioning will take 18 months in Benin.

Build and commissioning will take 18 months in Malta.

Agreement is for 15 years in Benin with a return on investment after 5 years.

Agreement is for 18 years in Malta with the selling price fixed for the the first 5 years

Dec 2012 – Gasol & SOCAR announce gas supply agreement for Benin.

Jan 2013 – Malta Labour Party announce gas and energy supply plan for Malta as part of their manifesto.

Interesting.

This situation contradicts what Joseph Muscat and Konrad Mizzi have been saying about Enemalta being bankrupt and that China is rushing in to save it.

1. Firstly, let’s clarify that Gasol plc is listed on the Alternative Investments Market of the London Stock Exchange – a market for companies without a track record.

2. Secondly, Gasol’s accounts at 31 March 2013 (that’s about the time of the share price increase), show a hole of £2 million in the equity capital of the company, caused by the fact that Gasol plc has more borrowings than assets.

This means that all of Gasol plc’s assets at 31 March 2013 were financed by its borrowings – and what’s more, those borrowings were also financing about £2 million due from the shareholders to the company because of losses suffered.

http://www.gasolplc.com/media/18507/2013_accounts.pdf

Gasol plc has been loss-making for the last 5 years. See link to the company’s fundamentals below.

http://www.londonstockexchange.com/exchange/prices/stocks/summary/fundamentals.html?fourWayKey=GB00B826T938GBGBXAIM

In the company’s accounts, the auditors have expressed an important reservation about the financial future of the company.

Yet, despite the losses and the holes, the company has a current market capitalisation of £6.2 million, and has had this value since about March 2013, as your chart shows.

This shows that a highly indebted company can still have a positive market value much higher than the hole in its capital according to the books.

So Joseph Muscat should please stop telling us that Enemalta is highly indebted and that it is bankrupt, because in fact, as part of his plan to “save Enemalta,” he is going to do business with a company that has more debt than assets and about which the auditors have made serious reservations.

And not only. He is trusting them with his political life, because he is trusting them with 30% of the delivery of his promise to reduce the electricity bills by 25% in 1 year from 9 March 2013 without resorting to other taxes.

What’s more, Joseph Muscat’s Energy Minister, Konrad Mizzi, said that the consortium which includes this company is a “world class team.”

Should highlight also that, in a twist of irony, it appears that the Malta/Enemalta project is going to be the salvation of Gasol plc. The company looks like a shelf company so far.

Let’s watch its share price, borrowings, ownership, and even whether it will remain listed on the LSE AIM from here on.

One of the fundamentals when assessing and judging a tender, even more so one of this magnitude, both in number and in repercussions, is the underlying financial strength, longevity and experience of the supplier.

This bidder should have been eliminated at the word go as it has none of the three pre-requisites above. It has no track record, has been making losses for years, has low capitalisation, and worse, suspect shareholding.

The PM and the Minister for Energy have committed this country to a cost that it cannot afford to a supplier that does not have the capability or experience of a successful and timely delivery.

If one had to look at the track record of the Maltese people involved one can only mention Milner Grove and the Union Club complex to see just what a mess they can do.

If one had to assess Siemens, whilst they might appear to be a very big name, all one has to do is see what has become of the Siemens company that was set up in Malta about 10 years ago. Enough said.

What rests to be seen is whether Muscat and Mizzi will resign when the 18 months are up, just like they promised. Believe that if you want to.

As a footnote to my earlier comment –

Apr 2013 – Gasol & SOCAR make a bid for the Malta gas and energy supply concession as part of the ElectroGas consortium.

some more interesting information

http://www.investegate.co.uk/gasol-plc–gas-/rns/electrogas-malta-preferred-bidder-for-lng-to-power/201310140700073801Q/

6.2m in capital? Quite a nobody then.

It would be interesting to know who actually bought those shares.

That’s exactly what I was thinking.

The Lega was caught red handed dabbling in Tanzania using its publicly supplied finances, even accused of bringing down a government to speculate on default swaps in its portfolio.

Same ideology, same tactics. No wonder Brussels is in the way.

Let me try to answer your question – with more questions.

The most likely reason for the increase in the share value of the company is that in March 2013, the company secured new borrowings. This gave a new breath of life to the company, which now is awash with cash. Almost as much as its market capitalisation value – in the region of £6 million. In fact, cash is the only real asset that the company has. It also has £3 million of “goodwill” in its books, but really, when a company has only been making losses, what goodwill can it have?

In fact, in March 2013, Gasol plc announced that it had secured a bond facility of $100 million, and that it had drawn down an initial $20 million.

http://www.gasolplc.com/media/17734/gasol_draws_down_us__20_million_on_new_bond_instrument.pdf

The main problem is that there is no information about who provided the company with this borrowing security. The announcement above mentions institutional investors, but it does not state who they are.

Who are those institutional investors? Chinese funds, maybe? Chinese sovereign funds? The Chinese government?

Who would lend $20 million (let alone offering up to $100 million) to a company which is practically a shelf company and which, as a consequence of the loan of $20 million, will have more debt than shareholders’ (equity) contributions?

Who would make a $100 million bond facility, let alone an unsecured loan, to a company operating in West Africa – technically a high risk region – and knowing that the company has no track record, unless it is someone who has some knowledge of certainty of future business?

What is the possibility that the institutional investors are already, effectively, the owners of the company?

What is the possibility that the institutional investors have in mind the conversion of the bond into share capital of the company? Or that they will make new injections of capital into the company and take it over?

Surely, Konrad Mizzi, the Minister of Transparency, has all the answers. Perhaps a journalist would care to ask him the questions.

Add on to that, and to my comments above, what due diligence was performed on these investors, be they institutional investors or not.

Are these bona fide investors, is the money legit, or are we running a risk of discovering down the line that the money was dirty and that people made a killing on commissions etc.

http://www.maltatoday.com.mt/en/newsdetails/news/national/Council-of-Europe-watchdog-flags-unfair-citizenship-laws-20131015

“A bizarre response from the government pertains to ECRI’s sources: “We regret that ECRI’s report, like its predecessors, relies heavily on anonymous sources. We have identified more than 20 instances of such phrases as ‘ECRI has been informed’… Maltese NGOs are well known, operate freely in public and have access to public funds. ECRI’s efforts to hide the identity of its sources are, therefore, regretted and out of place.””

The part of the govt. reply I preferred was this:

“ECRI’s report makes many recommendations but does not proceed to cost them, let alone to provide the necessary funds for their implementation.”

What a shameful reply.

Who would buy shares in a company, knowing the price it sells its product for will be fixed for five years?

Surely not someone who knows that after five years it can sell at any price it wants.

By the time the price is put up, who will be in government in Malta?

Why, the ones who’ll determine the price of course.

Daphne, please look at http://www.investegate.co.uk/aim/rns/schedule-1—gasol-plc/200806101758024211W/

I get there since the contact person in the domain “gasolplc.com” is Richard Allocca. In the link you can see all the names of the other directors:

Soumo Bose Chief Executive

Rachel English Chief Financial Officer

Theo Oerlemans Non-Executive Chairman (Proposed Director)

Paul Biggs Non-Executive Director

Charles Osezua Non-Executive Director

Haresh Kanabar Non-Executive Director

Osman Shahenshah Non-Executive Director

As well as other person related with the company:

Suneeta Chase

Miles Thomas

Richard Allocca

Rob Breen

Obi Iheme

Mark Ogden

We should go through the names but these company just looks like a front for somebody else.

The list of significant shareholders:

AFGAS 25,000,000/12.15 per cent

Blue Star Capital plc 21,666,666/10.53 per cent

Standard Life Investments 20,370,900/9.90 per cent

Afren plc 19,379,100/9.42 per cent

Artemis Investment Management 14,000,000/6.80 per cent

African Dawn Equity Partners 10,000,000/4.86 per cent

Fidelity International Limited 9,103,310/4.42 per cent

Gaia Resources Fund 8,022,491/3.90 per cent

Fairdale Consulting Limited 7,400,000/3.60 per cent

Bradshaw Asset Management 6,250,000/3.04 per cent

After Admission:

AFGAS 522,442,866/63.00 per cent

Synergy 75,000,000/9.04 per cent

EBT (Gasol plc EBT) 50,624,198/6.10 per cent

Soumo Bose profile from Linkedin:

Current

Chief Financial Officer and Member of Executive Management Committee at Oman Oil Company

Member of Board of Directors & Chairman Audit and Risk Management Committee at Oman Oil Exploration & Production LLC

Past

Member of Advisory Board at Oman Oil Exploration & Production LLC

Executive Director/CFO at Gas and Power Private Equity deals – London

Chief Executive Officer and Board Member at Gasol plc (downstream partner of Afren plc) – London

Education

Institute of Chartered Accountants

University of Calcutta

LaMartiniere

So GASOL is a “downstream partner” of AFREN PLC (www.afren.com).

Before, we knew exactly what was going to happen and people were able to plan from one day to the next.

Now, things are changing every minute.

My fear is that too many changes are happening without people knowing – they have no time to inform the public – rapid changes mean, no consultation with the public.

Very dangerous.

This map should help to understand the geographical locations of Benin, and then Togo, Ghana and Nigeria.

http://www.merriam-webster.com/maps/images/maps/togo_map.gif

Ignore Ethiopia for a moment – it is on the other side of the continent.

That’s what I’m thinking Ciccio: it’s altogether too convenient, especially when the connector maps are taken in focus: all the way to China.

Sorry to piss on your bonfire but this is by far the most likely explanation

http://www.reuters.com/finance/stocks/GASL.L/key-developments/article/2689088

Check the tracked share price and you will find there was no price surge on 7/8 Feb (in fact the share price went down on the day of announcement).

The share price started to surge a week later.

The Gasol share price really took off in the following week. Look how it tracks.

6 Feb – Volume of shares traded 0 – opening price 13.62 – closing price 13.62

7 Feb – Volume of shares traded 91,300 – opening price 15.00 – closing price 14.75

8 Feb – Volume of shares traded 9,300 – opening price 14.45 – closing price 14.75

11 Feb – Volume of shares traded 108,000 – opening price 15.23 – closing price 14.75

12 Feb – Volume of shares traded 0 – opening price 14.75 – closing price 14.75

13 Feb – Volume of shares traded 343,500 – opening price 15.20 – closing price 15.50

14 Feb – Volume of shares traded 299,500 – opening price 16.00 – closing price 17.12

15 Feb – Volume of shares traded 398,300 – opening price 17.12 – closing price 17.75

18 Feb – Volume of shares traded 203,200 – opening price 18.20 – closing price 19.38

19 Feb – Volume of shares traded 431,500 – opening price 19.40 – closing price 21.62

20 Feb – Volume of shares traded 132,900 – opening price 21.51 – closing price 21.25

21 Feb – Volume of shares traded 77,300 – opening price 21.51 – closing price 21.25

22 Feb – Volume of shares traded 58,700 – opening price 22.00 – closing price 21.38

What happened around 13 Feb to cause so much activity and make the share price jump in value?

Clearly someone (or something) thought the shares were worth having in what is just a tiny company.

The first thing to get hold of is a shareholder list for Gasol.

Wasn’t it meant for Enemalta to “enter into a power purchase agreement with the investors of the new power station, fixing the price of energy for 10 years.”?

http://www.timesofmalta.com/articles/view/20130108/news/pl-tariffs.452366#.Ul0YmjBBuM8

Can anybody point me to the original presentation used by PL in January? Thanks

You can find it on prezi here:

http://prezi.com/hh0r5pwapr7t/pls-energy-vision/?auth_key=444406384b5cb42558b80f1708a5dcb3a5795d0c

You will need to crate a prezi account though.

Thanks! It’s there, black on white with green bullets: PRICE WILL BE FIXED FOR A 10 YEAR PERIOD.

Now why is no journalist taking the government to task? Oh yeah, all journalists are employed by the government.

You can start here.

http://www.timesofmalta.com/articles/view/20130108/news/pl-tariffs.452366

10 years? On no, that was because they thought that they will be elected for 10 years, but once they were elected, somebody told them the term was only for 5 years.

Yes of course, and it was also implied this power station would somehow remain unpaid.

It was dead easy, Malta’s that simple.

http://www.socar.ro/en/SOCAR-AZERBAIJAN

http://www.telegraph.co.uk/news/matt/

It seems that the ‘Malta deal’ is what is keeping Gasol afloat.

My question is: Is Gasol plc solvent, or is it insolvent?

Gasol Plc

Annual Report and Financial Statements for year ending March 2013

http://www.gasolplc.com/media/18507/2013_accounts.pdf

Q&A with the company’s Chief Operating Officer

If we were to produce a map of West Africa highlighting Gasol’s operations/activities, could you tell us which countries you are active in and what kind of operations you have in those areas?

Our business is to supply gas to markets that are gas constrained. This market characteristic prevails as you travel up the West African coastline – Benin, Togo, Ghana, Cote d’Ivoire, Liberia, Sierra Leone, Guinea, Senegal, Mauritania. This is the market that we are concentrating on.

Incredible, there is not a slight hint or a strategic idea of tapping any other market other than the West African countries. This company has limited financing leverage and suddenly it announces that it has the right to conclude an agreement with Enemalta and the Maltese Government. The way I see it, not very convincing at all.

oh yes, another comment heard on the grapevine is the bus loads of Chinese seen visiting/arriving at Enemalta, interesting times

On Sunday it was announced that Maltese-Azeri investors won the gas plant deal. The same day, one of the shareholders told Times of Malta that the storage ship had already been contracted (I assume for 18 years). So in one day they managed to conclude such an important deal? Or as you are saying it was planned all along.

The share price behaviour is suspicious, to say the least, and I don’t believe in coincidence. The Stock Exchange should be informed, and the trading activity should be investigated by the Regulator. Your interpretation of events is logical.

To date, Gasoil plc seems to be no more than a shelf company, but I must say that if China or Chinese interests are somewhere behind the financing of Gasol, one must watch Gasol’s future development. We do not know, and may never know, who is providing Gasol with finance, especially the new bond facilities of $100 million announced in March 2013.

Gasol’s main focus is West Africa, particularly that covered by the West African Gas Pipeline, namely Nigeria, Benin, Togo and Ghana – four neighbouring countries.

This is a region rich in oil and gas. Nigeria has long been an oil producer, and there are still huge untapped reserves in the Niger Delta.

Ghana is a new producer of oil. Commercial production started in 2011. It is set to become one of Aftica’s largest producers of oil and gas.

China has been busy building its interests in Ghana, among other African countries.

http://ghanaoilonline.org/2010/09/china-extends-africa-push-with-loans-deal-in-ghana/

“Ghana and China signed project loans and another deal together totaling $15 billion, the latest in a string of Chinese investments on the continent.

The loans, coinciding with a six-day Beijing visit by the West African nation’s president, John Atta Mills, highlight China’s strong interest in resource-rich African countries such as Ghana. Ghana is preparing to tap massive oil fields that are expected to turn it into one of Africa’s biggest energy producers.”

That gives some perspective of what China is doing in Ghana, and why.

In April 2012, China made another loan to Ghana, directly into natural gas development. (Notice the timing, amount and destination of this massive loan).

http://www.bloomberg.com/news/2012-04-16/ghana-signs-1-billion-loan-with-china-for-natural-gas-project.html

“Ghana signed a $1 billion lending agreement with China Development Bank Corp. as part of the biggest loan in the country’s history that Vice President John Dramani Mahama said would provide hundreds of thousands of jobs and develop natural gas. ”

It almost sounds like doing “philanthropy for the benefit of people in Africa.” – can’t remember who said that, and in what context, though.

In 2010, China’s Exim Bank provided a $10.4 billion loan for the development of railways, roads and energy infrastructure.

http://www.ghanaweb.com/GhanaHomePage/NewsArchive/artikel.php?ID=190769

Shiv Nair boasts how he has helped in the tapping of Exim funds for the Ghana rail rehabilitation programme.

http://mt.linkedin.com/pub/shiv-shankaran-nair/19/bba/0

(I am actually starting to suspect that the World Bank permanently debarred Shiv Nair because he was stealing their loan business in Africa in favour of the Chinese government and its banks).

Which is why it would not be surprising if it is revealed that China is behind Gasol’s ventures in West Africa.

In February 2013, African Power Generation Limited, a Gasol affiliate, with which Gasol has an option agreement to buy the company, signed an MOU with the Ghana National Gas Company to supply imported gas.

http://www.oilreviewafrica.com/downstream/downstream/african-power-generation-signs-gas-mou-in-ghana

This fits with Gasol’s links with SOCAR to import LNG which will be stored in floating storage facilities planned in the port of Cotonou in Benin to be later regasified and feed into the West African Gas Pipeline.

Gasol has a number of MOUs or other agreements to help it benefit from gas and oil developments in the region.